The global supply chain crisis under the epidemic has brought a large number of return orders to China's textile industry.

Data from the General Administration of Customs show that in 2021, China's garment exports increased by nearly $33 billion (about 209.9 billion yuan) to $170.26 billion, reaching a new high since 2015. Before that, China's garment exports had been declining year by year as the textile industry moved to lower-cost regions such as Southeast Asia.

However, the return of production capacity brought about by the epidemic may not be sustainable. Zhou Liang, a partner of Ernst & Young Consulting Services, told First Finance that blindly immerging in the past low value-added development model is a waste of national resources, and China still needs to return to the original track and upgrade to the high value-added links of the clothing industry chain.

Return 200 billion

Under the favorable factors such as the recovery of external demand and the return of orders caused by the epidemic, China's garment exports have once again stood at the $170 billion mark after five years.

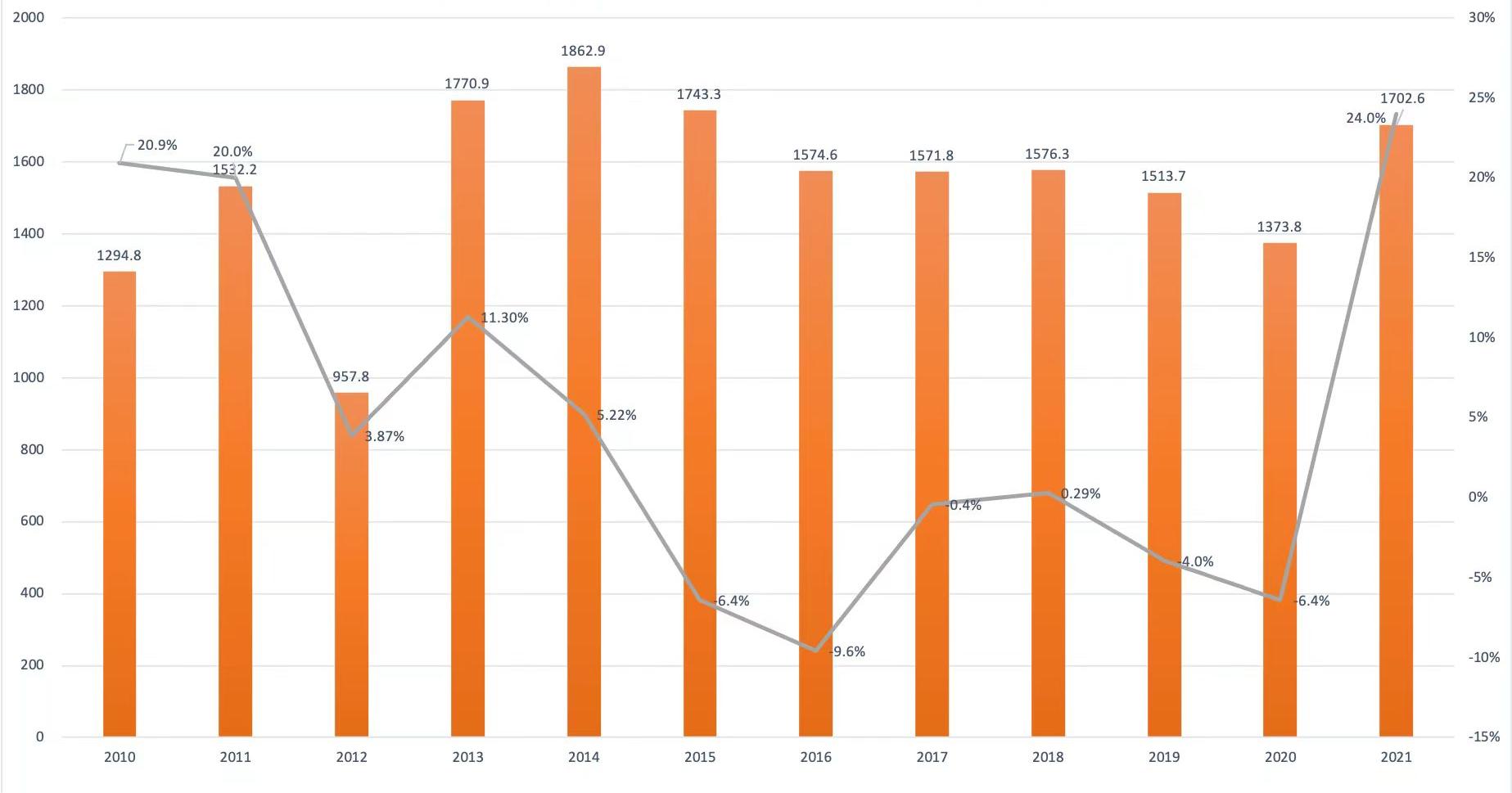

According to the statistics of the General Administration of Customs, the country's textile and apparel exports in 2021 were 315.47 billion US dollars (the diameter does not include mattresses, sleeping bags and other bedding), an increase of 8.4% year on year, hitting a historic high. Among them, the annual export of clothing was 170.26 billion US dollars, an increase of 24%, which was the largest growth rate in the past decade.

China is still the world's largest textile producer and exporter, but with the rise of domestic costs and the shift of international procurement trends, after reaching the peak of 186.28 billion US dollars in 2014, China's garment exports have been declining year by year, with an average growth rate of -4% during 2015-2020. Combined with the impact of the epidemic, exports in 2020 once fell to $137.38 billion, falling back to the level of 10 years ago.

Changes in China's garment exports from 2010 to 2021 (unit: USD 100 million)

Yellow bar chart: Garment exports

Gray graph: Garment export growth

Nearly ten years of apparel export data show that the growth curve in 2021 is particularly prominent, showing a steep contrarian growth. In 2021, foreign clothing orders returned more than 200 billion yuan, data from the National Bureau of Statistics show that from January to November 2021, the clothing industry output of 21.3 billion pieces, an increase of 8.5%, which means that foreign clothing orders increased by about 1.7 billion pieces a year.

Zhou Liang told First Financial News that due to institutional advantages, China had early and better controlled the COVID-19 epidemic during the epidemic period, and the industrial chain had basically recovered. In contrast, Southeast Asia and other places had affected production due to the repeated epidemic, making European, American, Japanese and Southeast Asian buyers transfer orders directly or indirectly to Chinese enterprises, bringing the return of clothing production capacity.

In terms of exporting countries, in 2021, China's apparel exports to the United States, the European Union and Japan increased by 36.7%, 21.9% and 6.3%, respectively, and exports to South Korea and Australia increased by 22.9% and 29.5%, respectively.

The position of the United States as China's largest textile and apparel export market is still stable, and in 2021, China's apparel exports to the United States exceeded 40 billion US dollars for the first time, hitting a record high of 41.13 billion US dollars. On the one hand, driven by the US fiscal and monetary stimulus program, the market demand has broken out in a compensatory way, and the US clothing retail has repeatedly hit a record high; On the other hand, despite the constant economic and trade friction between China and the United States, China with an efficient and stable industrial chain is still the most rational choice for buyers, and the United States still relies on China's garment industry.

After years of development, China's textile and garment industry has obvious competitive advantages, which not only has a complete industrial chain, a high level of processing and supporting, but also has many developed industrial clusters. During the epidemic, China, as the center of the world's textile and garment industry chain, has strong resilience and comprehensive advantages, and has played the role of "anchoring the sea".

CCTV previously reported that affected by the epidemic, many textile and garment enterprises in India, Pakistan and other countries could not guarantee normal delivery, and European and American retailers transferred a large number of orders to China for production in order to ensure continuous supply. Wang Desheng, general manager of Foshan Ligao Garment Co., Ltd. in Guangdong province, said that the factory's orders in mid-2021 had been lined up by the end of the year, and the orders from Australia had even been lined up until 2022.

The general trend of industrial transfer

The return of orders brought about by the capacity substitution effect under the epidemic may not be sustainable.

Zhou Liang believes that the recovery of the domestic garment manufacturing industry during the epidemic is a "false prosperity" : "The epidemic will pass sooner or later, China still needs to return to the original track."

With the resumption of production in Southeast Asia and other countries, orders previously returned to the country have begun to transfer back to Southeast Asia. According to the data, in December 2021, Vietnam's garment exports to the world increased by 50% year-on-year, and exports to the United States increased by 66.6%.

According to the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), the country's ready-to-wear shipments increased by about 52% year-on-year to $3.8 billion in December 2021. Despite the factory shutdown due to the epidemic, strikes and other reasons, the total annual apparel exports of Bangladesh in 2021 still increased by 30%.

In the second half of 2021, the growth rate of domestic apparel exports is also gradually slowing down. In the first and second quarters of 2021, due to the recovery of international market demand and the small base in the same period last year, China's garment exports grew rapidly, and the growth rate slowed down significantly in the third quarter, and the growth rate rose to a certain extent in the fourth quarter due to the favorable holiday procurement demand in foreign markets.

Quarterly Change of China's garment Exports in 2021 (unit: USD 100 million)

Blue bar chart: Garment exports

Yellow graph: garment export growth rate

The epidemic has slowed down the transfer of the textile industry to Southeast Asia and other countries, but as the epidemic is gradually controlled, the global textile and garment manufacturing will continue to accelerate the transfer to Southeast Asia and other places. Jiansheng Group, a textile and apparel company in Zhejiang, pointed out in its semi-annual report for 2021 that "it is still the general trend to transfer middle and low-end production capacity to Southeast Asian countries with lower factor costs and less disturbance of tariff disputes."The manufacturing cost of a T-shirt in China is five times that of Southeast Asia, a garment industry source said: "A cotton T-shirt produced in Bangladesh, the local raw materials plus labor costs less than $1, to the European and American terminal market discount stores sell 5-8 dollars, and in Guangdong to produce the same raw materials of a T-shirt, labor costs more than $5, the market price has to double."

"In the past, Chinese labor was cheap, so European garment manufacturers were willing to come to China to take goods, and now India, Bangladesh, Turkey have replaced this advantage." The industry said.

China's market share in major importing countries is declining year by year. From January to November 2021, according to the statistics of importing countries (regions), China accounted for 30.6% and 56.9% of imports of clothing from the United States and Japan, respectively, down 8.5 and 1.8 percentage points from the high point in 2020, even if compared with the pre-epidemic 2019, the share of the US market also fell by 2.6 percentage points. In 2009, the share of Chinese clothing imports in the United States and Japan reached 36.6% and 82.9%, respectively.

With the acceleration of the resumption of work and production in Southeast Asia and other places, orders are flowing out of the country again, and the market share of Chinese clothing in developed countries is likely to continue to show a slow decline.

Zhou Liang believes that the relocation of low value-added industries to Southeast Asia, where there are comparative advantages, to form a regional industrial chain is the future of the whole pattern, and for China, such a reduction in exports is not necessarily a bad thing.

Toward textile and garment power

Despite having more than $170 billion in apparel exports, the National Bureau of Statistics data show that the operating profit margin of the export apparel industry in 2021 is less than 5%, affected by factors such as rising raw material prices, and the overall profit level has continued to decline in recent years.

An industry person bluntly, China's textile industry has a big but not strong problem, the future to increase industrial upgrading efforts, the pursuit of moderate profits is the king.

Textile and garment value chain includes raw material production, fabric production, product design and textile and garment manufacturing, among which textile and garment manufacturing is a labor-intensive link in the garment value chain with low profit rate and the fiercest competition.

Zhou Liang believes that if blindly immersed in the past development model, the development of low value-added labor-intensive industries, is a waste of national resources, "international trade in the processing of orders for the Chinese economy is not good," he said, "GDP and employment up, but the profit added value does not stay in China, is taken away by the upstream, at the expense of our environment and energy." "

Chen Zhonghao, co-founder of Zhijing Technology, mentioned in an interview with the first financial reporter that the government has said that the state subsidize electricity for enterprises in electricity energy, but some enterprises produce some products with a gross profit of only 3-5 points to sell, and even earn no energy consumption. "Both the country and the industry want to restructure and upgrade the overall structure of the industry, and phase out low-end products."

In the garment industry chain, fabric production and product design are the value-added and high value-added links of the value chain. The fabric process of clothing is closely related to high-tech, which is a technology-intensive link, while product design needs the common support of economy and culture, which is an intelligence-intensive link.

"The epidemic will pass sooner or later, and China needs to move to the high-end environment of the industrial chain and turn labor-intensive industries into technology-based industries." Zhou Liang thinks.

The transformation and upgrading of the textile and garment industry is also a road taken by Japan and other textile powers, and its transformation experience may be a reference.

The textile industry has played a huge role in the revitalization of the Japanese economy, but after the 1980s, with the increasing labor costs and other factors, Japan's textile exports fell sharply. Since then, the Japanese government has increased its investment in research and development of high-end chemical fiber materials and textile machinery, focused on cultivating high-end clothing design talents, and moved low-end manufacturing links abroad, and concentrated domestic resources to produce popular garments and apparel products with higher added value.

At present, Japan has Miyake Life, KENZO, Uniqlo and other world-renowned clothing brands, and has the top chemical fiber technology second only to the United States, Japan Toray company is the "king of new materials" carbon fiber in the world's largest manufacturer, with more than 30% of the global carbon fiber market share. At present, China's carbon fiber materials are still heavily dependent on foreign imports, and about 20% of imports in 2019 are from Japan.

Despite the return of manufacturing capacity brought about by the epidemic, China still has to return to the track of industrial upgrading, such as Japan and other countries have experienced, stripping low-end manufacturing links and investing in high value-added links in the textile and garment industry.

China not only has a strong garment industry foundation, but also has a new demographic dividend - the vast number of middle-income consumer groups, becoming a textile and garment industry power is only a matter of time.

Contact: Mr. Zhang

Phone: 17896381338

E-mail: honor@honorgroupltd.com

Add: No.12308, Jingshi road, Jinan,Shandong, China